Are you ready to buy a home, but your credit is not?

A credit score predicts how likely you are to pay back a loan on time. Companies use a mathematical formula or scoring model to create your credit score from the information in your credit report.

The credit report helps companies to offer you a mortgage, credit card, loans, or other credit products according to your capabilities. They are also used to determine the interest rate you receive on a loan or credit card, and the credit limit.

There are three credit agencies: TransUnion, Equifax, and Experian. They collect and house the information that helps potential lenders or employers rate your reliability.

Credit agencies collect the following information to create a credit report:

Personal information

- Your name and any name you may have used in the past in connection with a credit account, including nicknames

- Current and former addresses

- Birth date

- Social Security number

- Phone numbers

Credit accounts

- Current and historical credit accounts, including the type of account (mortgage, installment, etc.)

- The credit limit or amount

- Account balance and payment history

- Date the account was opened and closed

- The name of the entity you owe money to

Collection items /Public Records

- Liens

- Foreclosures

- Bankruptcies

- Civil suits and judgments

A credit report may include information on overdue child support.

Inquiries

- Companies that have accessed your credit report.

How is a credit score calculated?

Credit scoring companies calculate your scores from the data in your credit reports. Credit scores can be obtained score from your credit card company, financial institution, or loan statement. You can also use a credit score service or free credit scoring site.*

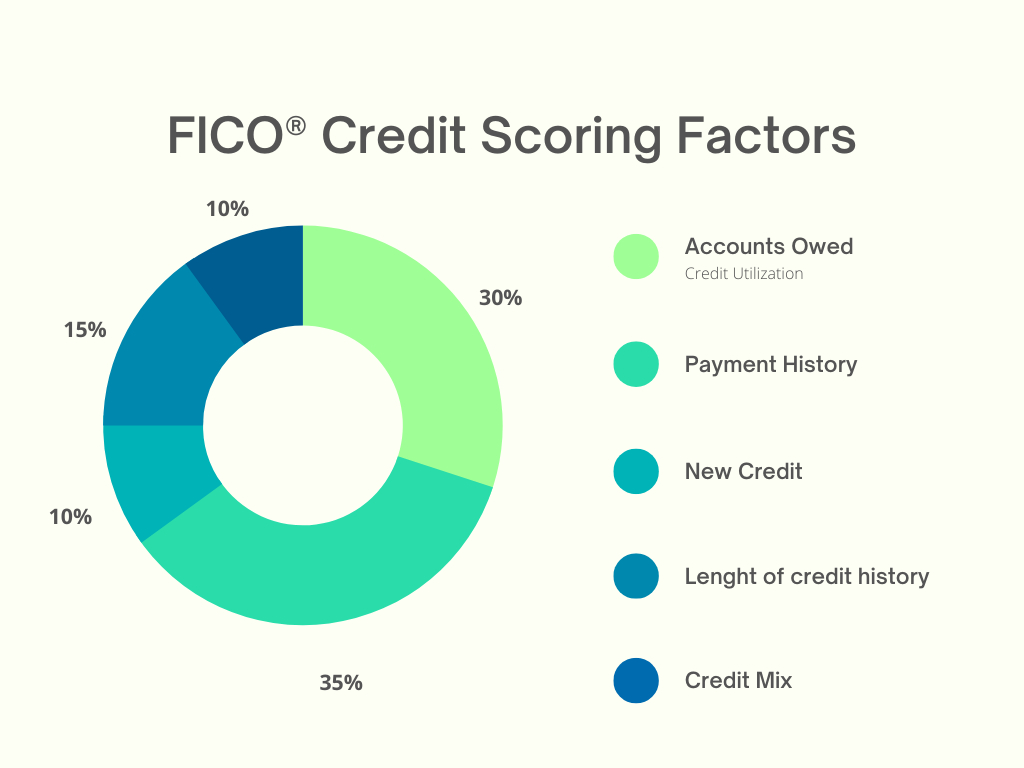

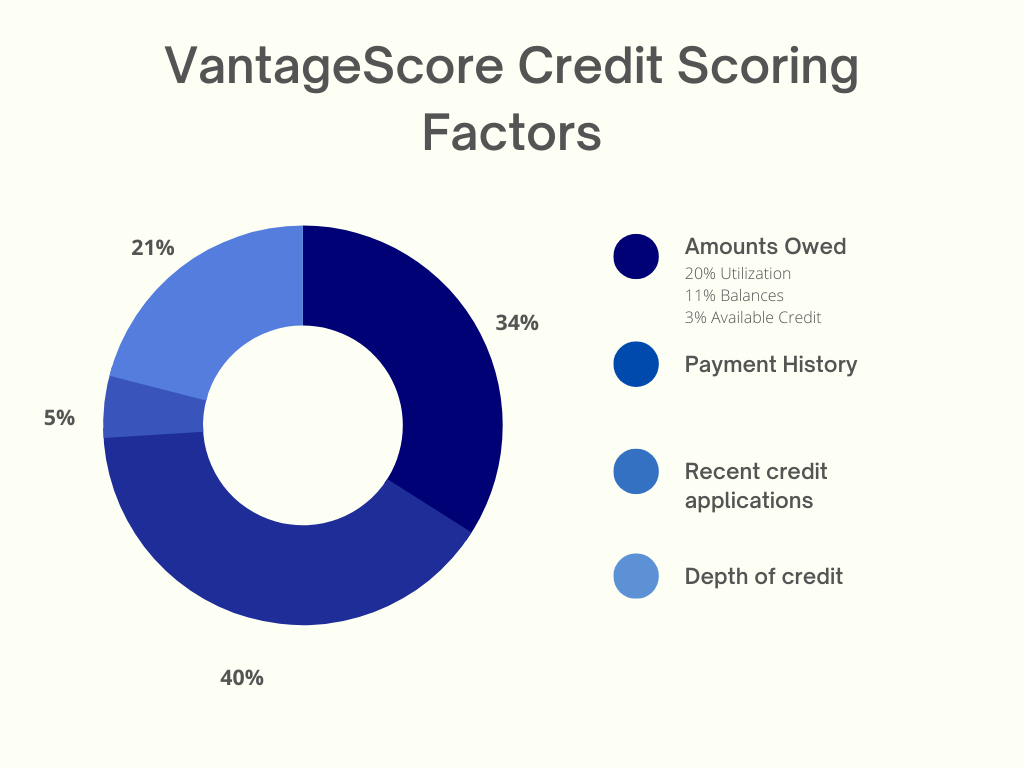

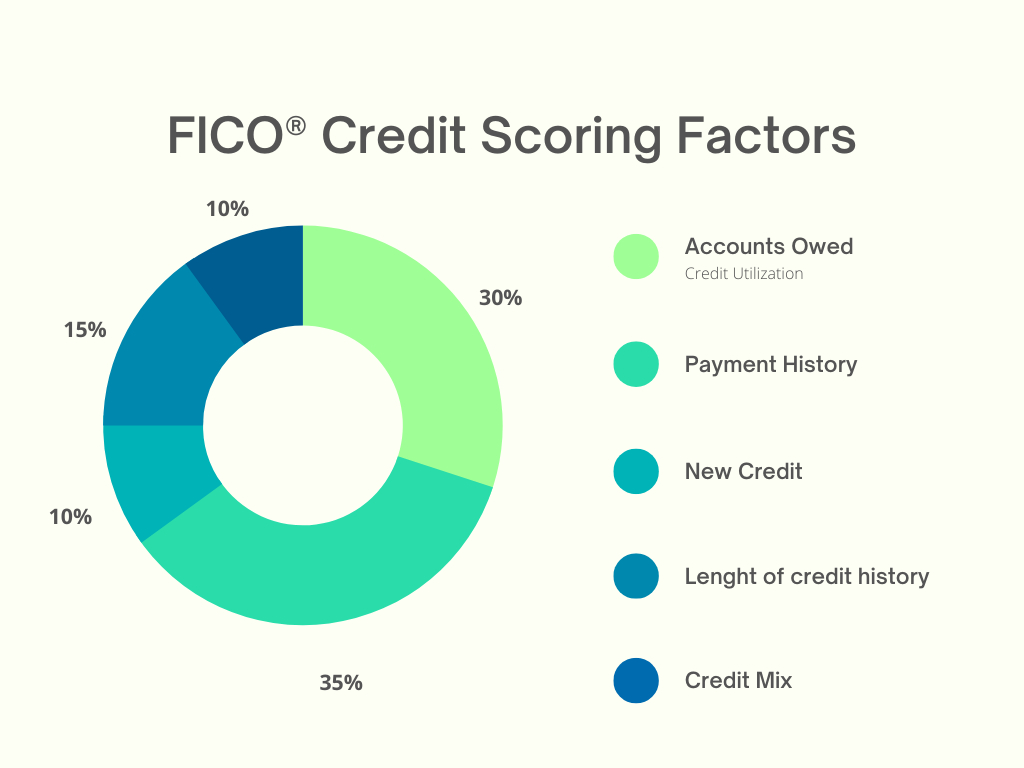

Some factors that are considered for a credit score are:

Payment history: Even one late payment can hurt your credit health

Current debt: the amount owed typically impacts your ability to pay all monthly credit obligations on time

Total accounts: Credit cards, auto, or student loans

Credit age: Average age of open accounts

Credit card usage: Try to stay under 30% - you don't need to carry any credit card debt to build your credit

Credit applications: Try to plan ahead and minimize hard inquiries at least 9-12 months before applying for a mortgage or big loan

Derogatory marks: Collections, bankruptcies, civil judgments, or tax liens

Any credit score depends on the data used to calculate it and may differ depending on the scoring model, the source of your credit history, the type of loan product, and even the day when it was calculated.

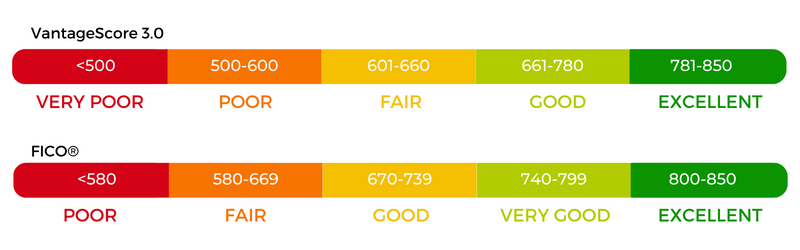

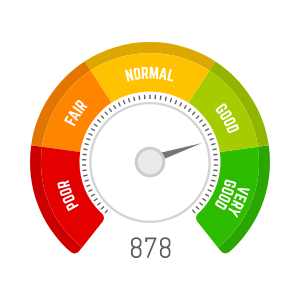

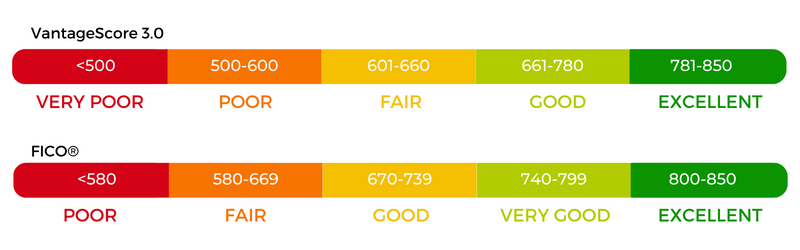

Usually, a higher score makes it easier to qualify for a loan and may result in a better interest rate. Most credit scores range from 300-850.

*It is important to know that there are many credit scores available to you as well as to lenders.

*It is important to know that there are many credit scores available to you as well as to lenders.

What Factors Affect Your Credit Scores?

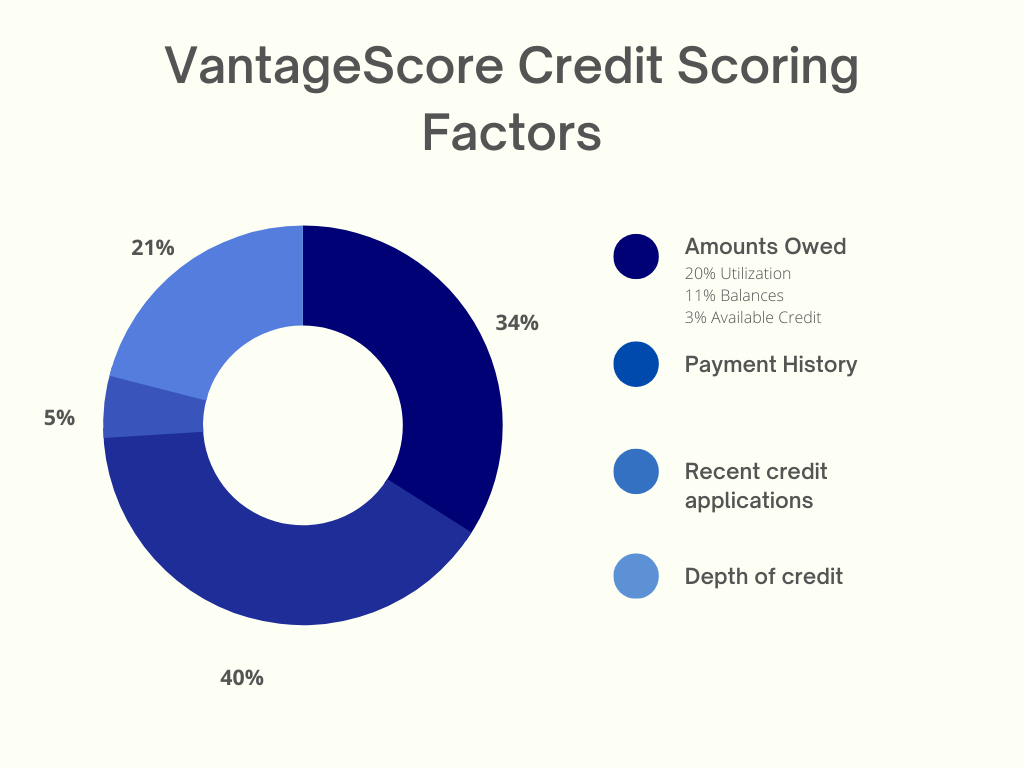

The two major scoring companies in the U.S. are FICO® and VantageScore. A FICO score is a three-digit number, that tells lenders how likely a consumer is to repay borrowed money based on their credit history. VantageScore was created by the three credit agencies, to help consumers gain more credit access, and allow lenders to make better lending decisions.

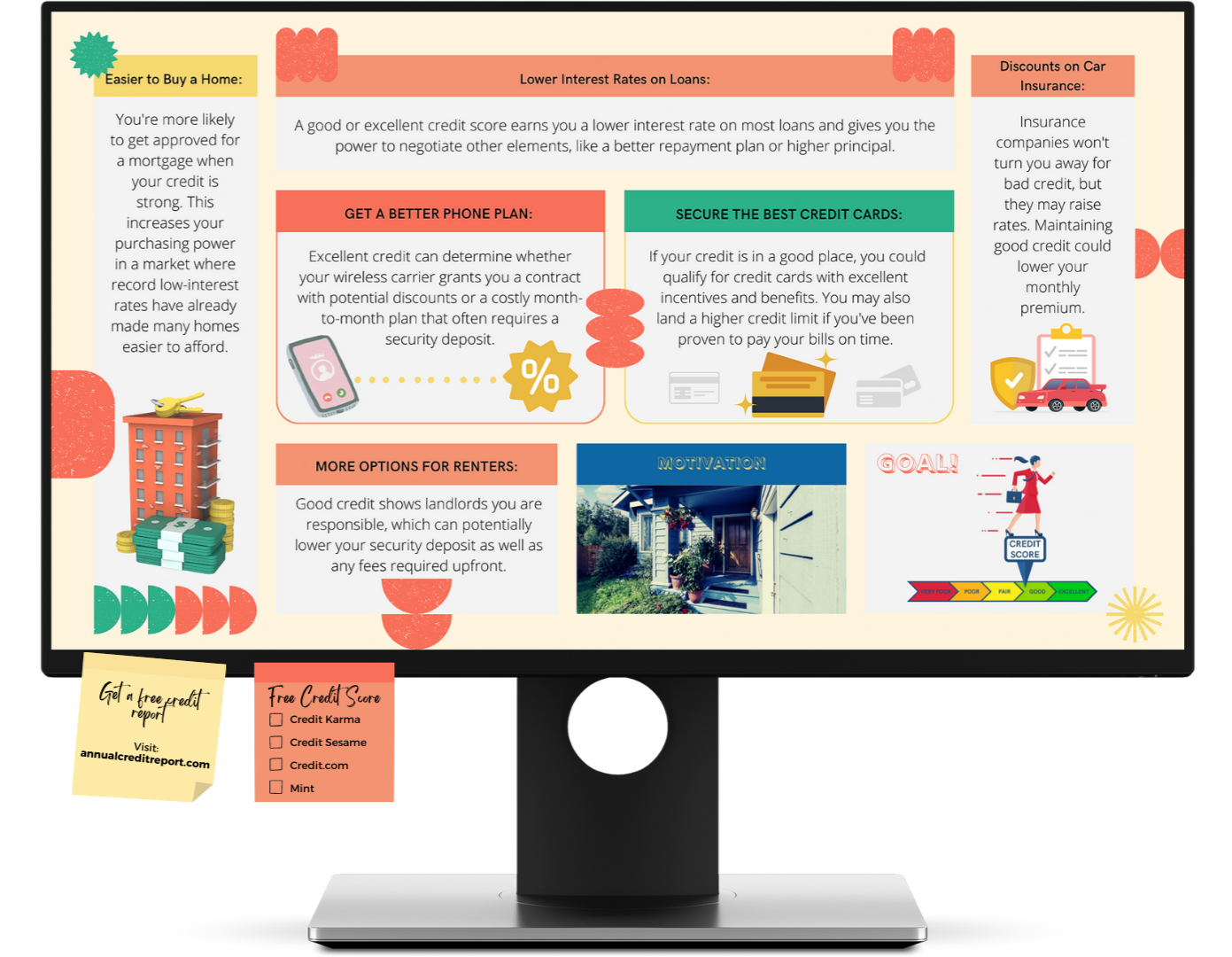

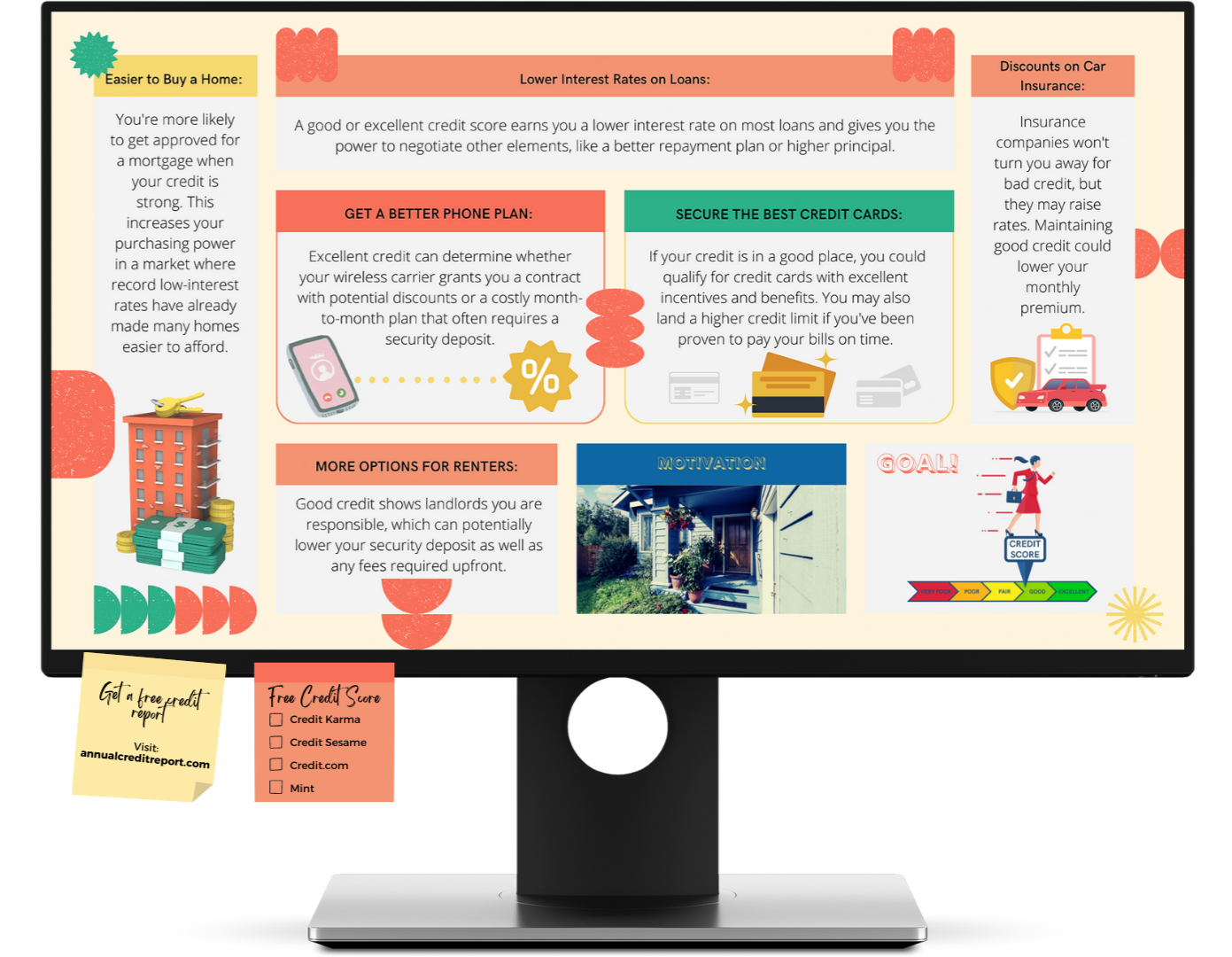

1. Easier to Buy a Home: You're more likely to get approved for a mortgage when your credit is strong. This increases your purchasing power in a market where record low-interest rates have already made many homes easier to afford.

2. Lower Interest Rates on Loans: A good or excellent credit score earns you a lower interest rate on most loans and gives you the power to negotiate other elements, like a better repayment plan or higher principal.

3. Discounts on Car Insurance: Insurance companies won't turn you away for bad credit, but they may raise rates. Maintaining good credit could lower your monthly premium.

4. Get a Better Phone Plan: Excellent credit can determine whether your wireless carrier grants you a contract with potential discounts or a costly month-to-month plan that often requires a security deposit.

5. Secure the Best Credit Cards: If your credit is in a good place, you could qualify for credit cards with excellent incentives and benefits. You may also land a higher credit limit if you've been proven to pay your bills on time.

6. More Options For Renters: Good credit shows landlords you are responsible, which can potentially lower your security deposit as well as any fees required upfront.

Tips for Building Excellent Credit

Strong credit matters

Check out these tips for building and maintaining an excellent credit score!

Pay on Time

Payment history is the largest part of your score, so pay bills on time to keep your score high.

Pay Attention to Your Score

Monitor your credit score regularly to know where you stand. Consider running your credit report to check for possible errors if it's lower than you thought.

Be Patient

While negative credit information is frustrating, it typically ages off your credit report after a few years, depending on the situation.

Keep Balances Low

Aim to use less than 30% of your credit limit (Under 10% is even better).

DISCLAIMER: We are not experts on credit building, this information is deemed reliable but is not guaranteed. Please consult your own professional advisor.

Share

Based on information from California Regional Multiple Listing Service, Inc. as of 02-27-2026 9:31 pm. This information is for your personal, non-commercial use and may not be used for any purpose other than to identify prospective properties you may be interested in purchasing. Display of MLS data is usually deemed reliable but is NOT guaranteed accurate by the MLS. Buyers are responsible for verifying the accuracy of all information and should investigate the data themselves or retain appropriate professionals. Information from sources other than the Listing Agent may have been included in the MLS data. Unless otherwise specified in writing, Broker/Agent has not and will not verify any information obtained from other sources. The Broker/Agent providing the information contained herein may or may not have been the Listing and/or Selling Agent.

This information is deemed reliable but not guaranteed. You should rely on this information only to decide whether or not to further investigate a particular property. BEFORE MAKING ANY OTHER DECISION, YOU SHOULD PERSONALLY INVESTIGATE THE FACTS (e.g. square footage and lot size) with the assistance of an appropriate professional. You may use this information only to identify properties you may be interested in investigating further. All uses except for personal, non-commercial use in accordance with the foregoing purpose are prohibited. Redistribution or copying of this information, any photographs or video tours is strictly prohibited. This information is derived from the Internet Data Exchange (IDX) service provided by San Diego Multiple Listing Service, Inc. Displayed property listings may be held by a brokerage firm other than the broker and/or agent responsible for this display. The information and any photographs and video tours and the compilation from which they are derived is protected by copyright. Copyright © 2026 San Diego Multiple Listing Service, Inc.

Based on information from the TARMLS 2026. All information provided is deemed reliable but is not guaranteed and should be independently verified. TARMLS, Estately and their affiliates provide the MLS and all content therein “AS IS” and without any warranty, express or implied. The information included in this listing is provided exclusively for consumers personal, non-commercial use and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. The information on each listing is furnished by the owner and deemed reliable to the best of his/her knowledge, but should be verified by the purchaser. TARMLS and Estately assume no responsibility for typographical errors, misprints or misinformation. This property is offered without respect to any protected classes in accordance with the law. Some real estate firms do not participate in IDX and their listings do not appear on this website. Some properties listed with participating firms do not appear on this website at the request of the seller. Data last updated: 09-10-2024 8:30 pm

The listing content relating to real estate for sale on this web site comes in part from the Alaska Listing ExchangeSM (ALE) of Alaska Multiple Listing Service, Inc. (AK MLS). Real estate listings held by brokerage firms other than the firm which owns this website are marked with either the listing brokerage's logo or the ALE logo and information about them includes the name of the listing brokerage. All information is deemed reliable but is not guaranteed and should be independently verified for accuracy. Listing content scraping by unauthorized personnel is strictly prohibited. Copyright © 2026 Alaska Multiple Listing Service, Inc. All rights reserved. Last Updated: 02-27-2026 9:30 pm

The data relating to real estate for sale on this web site comes in part from the INTERNET DATA EXCHANGE Program of the Greater Las Vegas Association of REALTORS® MLS. Real estate listings held by brokerage firms other than this site owner are marked with the IDX logo. Information is deemed reliable but not guaranteed. Copyright © 2026 of the Greater Las Vegas Association of REALTORS® MLS. All rights reserved. The listing broker's offer of compensation is made only to participants of the MLS where the listing is filed.

Bay East © 2026. CCAR © 2026. bridgeMLS © 2026. Information Deemed Reliable But Not Guaranteed. This information is being provided by the Bay East MLS, or CCAR MLS, or bridgeMLS. The listings presented here may or may not be listed by the Broker/Agent operating this website. This information is intended for the personal use of consumers and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Data last updated at 01-21-2022 9:00 pm.

The data relating to real estate for sale on this web site comes in part from the Internet Data Exchange ('IDX') program of Greater Fairbanks Board of REALTORS®. Information deemed reliable but not guaranteed. IDX information is provided exclusively for consumers personal, non-commercial use and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information deemed reliable but not guaranteed. Copyright © 2026 Greater Fairbanks Board of REALTORS®. All Rights Reserved.

Based on information from the California Desert Association of REALTORS © as of 02-27-2026 9:30 pm. All data, including all measurements and calculations of area, is obtained from various sources and has not been, and will not be, verified by broker or MLS. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information. The information provided is for consumers' personal, non-commercial use and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. All properties are subject to prior sale or withdrawal. All information provided is deemed reliable but is not guaranteed accurate, and should be independently verified.

IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information is deemed reliable but not guaranteed. The listing broker's offer of compensation is made only to participants of the MLS where the listing is filed.

All data, including all measurements and calculations of area, is obtained from various sources and has not been, and will not be, verified by broker or MLS. All information should be independently reviewed and verified for accuracy. Listings on this page identified as belonging to another listing firm are based upon data obtained from the PAAR MLS, which data is copyrighted by the Prescott Area Association of REALTORS® but is not warranted.

IDX information is provided exclusively for consumers personal, non-commercial use, that it may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. IMLS does not assume any liability for missing or inaccurate data. Any search result and subsequent display of listings must have the following disclaimer: Information provided by IMLS is deemed reliable but not guaranteed.

The data relating to real estate for sale on this web site comes in part from the Internet Data exchange ('IDX') program of Greater Pocatello Association of REALTORS® Multiple Listing Service. IDX information is provided exclusively for consumers personal, non-commercial use and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information deemed reliable but not guaranteed. Copyright © 2026 Greater Pocatello Association of REALTORS® Multiple Listing Service. All Rights Reserved.

The information is being provided by Northeast Oklahoma Real Estate Services, Inc. Information deemed reliable but not guaranteed. Information is provided for consumers personal, non-commercial use, and may not be used for any purpose other than the identification of potential properties for purchase. Copyright © 2026 Northeast Oklahoma Real Estate Services, Inc. All Rights Reserved.

IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information is deemed reliable but not guaranteed. The listing broker's offer of compensation is made only to participants of the MLS where the listing is filed. Listing last modified: 02-27-2026 9:30 pm

Listing information provided in part by the North Texas Real Estate Information Systems, Inc, for personal, non-commercial use by viewers of this site and may not be reproduced or redistributed. All information is deemed reliable but not guaranteed. Copyright © NTREIS 2026. All rights reserved

The data relating to real estate for sale on this web site comes in part from the Broker Reciprocity Program of the Mount Rushmore Area Association of REALTORS® Multiple Listing Service. Real estate listings held by other brokerage firms are marked with the Broker Reciprocity™ logo and detailed information about them includes the name of the listing brokers. Information Deemed Reliable But Not Guaranteed. The broker(s) providing this data believes it to be correct, but advises interested parties to confirm the data before relying on it in a purchase decision. Copyright © 2026 Mount Rushmore Area Association of REALTORS®., Inc. Multiple Listing Service. All rights reserved.

IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information is deemed reliable but not guaranteed. The listing broker's offer of compensation is made only to participants of the MLS where the listing is filed. Listing last modified: 02-27-2026 9:30 pm

Copyright © 2026 Big Bear Association of Realtors. All rights reserved. Information is deemed reliable but not guaranteed.

Based on information from California Regional Multiple Listing Service, Inc. as of 07-28-2022 6:05 pm. This information is for your personal, non-commercial use and may not be used for any purpose other than to identify prospective properties you may be interested in purchasing. Display of MLS data is usually deemed reliable but is NOT guaranteed accurate by the MLS. Buyers are responsible for verifying the accuracy of all information and should investigate the data themselves or retain appropriate professionals. Information from sources other than the Listing Agent may have been included in the MLS data. Unless otherwise specified in writing, Broker/Agent has not and will not verify any information obtained from other sources. The Broker/Agent providing the information contained herein may or may not have been the Listing and/or Selling Agent.

Listing courtesy of REALTRACS as distributed by MLS GRID. Based on information submitted to the MLS GRID as of 10-03-2024 3:30 pm. All data is obtained from various sources and may not have been verified by broker or MLS GRID. Supplied Open House Information is subject to change without notice. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information.

Listings identified with the FMLS IDX logo come from FMLS and are held by brokerage firms other than the owner of this website. The listing brokerage is identified in any listing details. Information is deemed reliable but is not guaranteed. If you believe any FMLS listing contains material that infringes your copyrighted work please click

here to review our DMCA policy and learn how to submit a takedown request. Copyright © 2026 First Multiple Listing Service, Inc.

Based on information from CRISNet MLS as of 09-14-2023 4:30 pm. All data, including all measurements and calculations of area, is obtained from various sources and has not been, and will not be, verified by broker or MLS. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information. The listing broker's offer of compensation is made only to participants of the MLS where the listing is filed.

IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information is deemed reliable but not guaranteed. The listing broker’s offer of compensation is made only to participants of the MLS where the listing is filed. Listing last modified: 02-27-2026 9:34 pm

IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information is deemed reliable but not guaranteed. The listing broker's offer of compensation is made only to participants of the MLS where the listing is filed.

Based on information from the Fresno Association of REALTORS® (alternatively, from the Fresno MLS) as of 02-27-2026 9:31 pm. All data, including all measurements and calculations of area, is obtained from various sources and has not been, and will not be, verified by broker or MLS. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information.

IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information is deemed reliable but not guaranteed. The listing broker's offer of compensation is made only to participants of the MLS where the listing is filed.

IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information is deemed reliable but not guaranteed. The listing broker's offer of compensation is made only to participants of the MLS where the listing is filed.

IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information is deemed reliable but not guaranteed. The listing broker's offer of compensation is made only to participants of the MLS where the listing is filed.

IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information is deemed reliable but not guaranteed. The listing broker's offer of compensation is made only to participants of the MLS where the listing is filed.

IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information is deemed reliable but not guaranteed. The listing broker's offer of compensation is made only to participants of the MLS where the listing is filed.

IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. Information is deemed reliable but not guaranteed. The listing broker's offer of compensation is made only to participants of the MLS where the listing is filed.

*It is important to know that there are many credit scores available to you as well as to lenders.

*It is important to know that there are many credit scores available to you as well as to lenders.